The Liberal government has officially abandoned its promise to balance the books by 2019, forging ahead with plans to spend billions on infrastructure projects and tax benefits for the middle class amid significant deficit projections for the next four years.

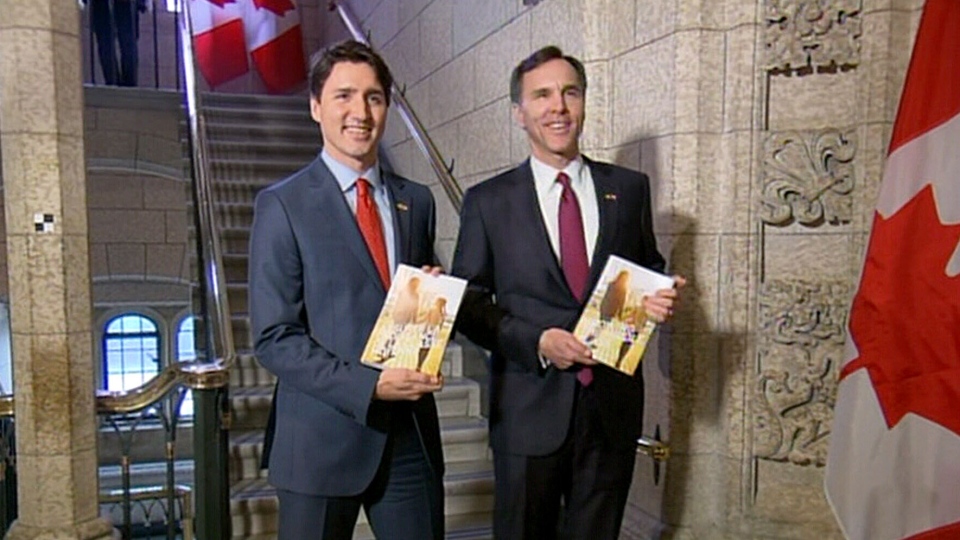

Finance Minister Bill Morneau’s first budget, tabled on Tuesday, projects deficits of $29.4 billion this year and $29 billion in 2017-18 – nearly triple the maximum amount of “modest” annual deficits the Liberals promised to run over three years.

By 2019-20, the government is expected to run a deficit of $17.7 billion instead of a balanced budget, as promised. The federal debt is projected at $718.2 billion for that year.

In his speech to the House of Commons on Tuesday, Morneau called the Liberals’ budget plan “reasonable and affordable” at a time when declining oil and commodity prices are hurting the economy.

“This budget puts people first and delivers the help Canadians need right now,” he said. “It is an essential step in a sustained, strategic effort to restore prosperity and optimism.”

The 2016 budget highlights include:

- $11.9 billion over five years to modernize and upgrade infrastructure systems, including transit and water

- $23 billion in 2016-17 to administer the new Canada Child Benefit

- $8.4 billion over 5 years for Canada’s indigenous people and their communities

- $40 million over two years for the inquiry into missing and murdered indigenous women

- $2 billion over three years for a new post-secondary strategic investment fund

- Elimination of income –tax splitting for couples with children, as well as children’s fitness and arts credits

- Extension of employment insurance benefits in hard-hit areas, plus reduction of EI waiting period

- Deferral of plans to purchase $3.7 billion worth of ships, planes and vehicles for National Defence

- $35 million over five years for a new counter-radicalization office

- More than $1 billion over four years for clean technology investments

The $30-billion deficit doesn’t come as a big surprise, since Morneau was actively managing expectations with economic outlook updates ahead of budget day, said Fred O’Riordan, an analyst with Ernst & Young LLP.

“We were conditioned to expect the new normal now -- instead of a $10-billion deficit, a $30-billion deficit,” he told CTVNews.ca.

O’Riordan said the projected shortfall is not alarming when considered in the overall context of Canada’s $2-trillion economy.

“There’s no magic (rule) that says you have to have a surplus or you should have a deficit,” he said.

What the 2016 budget outlines is a stimulus plan, O’Riordan said, although the Liberals have avoided describing it as such, instead using words like “investment” and “boost.”

It remains to be seen whether the economy will improve enough over the next couple of years for the Liberals’ deficit plan to make sense, O’Riordan said.

Morneau told reporters in the budget lock-up Tuesday that the billions in planned spending are “important investments” in Canada’s future.

Since interest rates are low, the government can borrow money on “excellent terms,” he said, adding that the budget will be balanced “over time.”

The first phase of the Liberals’ infrastructure plan includes $3.4 billion over three years to upgrade public transit systems across the country, $5 billion over five years for investments in water, wastewater and green infrastructure projects, and $3.4 billion over five years for social infrastructure.

Over the next decade, the government plans to invest more than $120 billion in infrastructure.

Pocketbook measures

The Liberals have already implemented a new tax package that reduces income tax rates for middle-class earners and raises taxes for Canadians earning more than $200,000 per year.

In Tuesday’s budget, the government outlined the other major component of its much-touted plan to boost the middle class. The new, tax-free Canada Child Free Benefit will allow low-and-middle income families to collect more money, with the maximum annual benefit of up to $6,000 per child under the age of six and up to $5,400 per child aged six through 17.

However, the Liberals are getting rid of the children’s fitness and arts tax credits, introduced by the Conservative government. Those credits, currently worth up to $150 per child, will be cut in half this year and eliminated as of 2017.

The budget also aims to make post-secondary education more affordable by increasing the Canada Student Grant amounts by 50 per cent for students from low and middle income families, as well as part-time students.