The Canadian Taxpayers' Federation is asking Quebec to lower its taxes on gasoline.

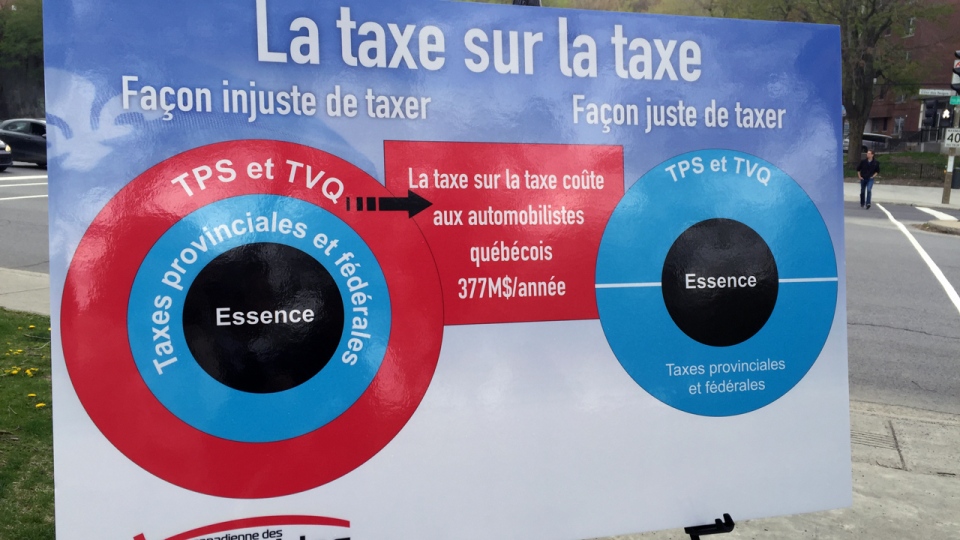

Specifically, the group objects to Quebec drivers being charged tax on top of tax.

About 40% of the price at the pump is tax, namely federal excise tax, provincial fuel tax, carbon tax, and transit tax. GST and PST are then calculated on that amount.

The CTF believes the total for the average driver is about $100 per year in taxes on taxes.

Carl Vallée of the CTF said he is also concerned that money which is earmarked for fixing roads goes to general revenue instead.

"I think we can see it in Montreal particularly, the roads are not in good shape and what the government was supposed to be doing is taking the money from gas taxes and using it exclusively for roads and infrastructure. They are clearly not doing that and we need to make them accountable for that," said Vallée.

According to the Auditor General of Montreal, one major cause of damage to roads in the city is inadequate asphalt. He has pointed out in a recent report that the city of Montreal was not testing the materials used by contractors to build.

Another common cause of road damage is heavier vehicles, with studies by U.S. authorities indicating damage increases exponentially with weight.

Vallée believes that gasoline taxes should be lowered, or reserved for road repair.

"They are using that money for a bunch of other programs to make sure that the revenue of the government goes up but they are not actually using it for the right reasons so either use it for the infrastructure or lower taxes," he said.

The CTF estimates calculating the GST and PST separately in Quebec, instead of on top of excise taxes, would cost the federal and provincial governments $344 million per year.