Laurentian Bank will cut 350 jobs in the coming year, about 10 percent of its workforce, after the financial institution saw its profits dive by a third in the first quarter.

The restructuring is part of the bank's plan to transform how it does business and the services it provides in its branches.

It will offer financial advice only in branches by the end of the year, and so cut administrative functions through attrition, early retirement and targeted job cuts.

For the quarter ending January 31, Laurentian posted a net income of $40.3 million, with total sales of just $242.3 million.

Excluding non-recurring items, the bank's adjusted profit was $44.7 million, or 98 cents per share, compared to $63.2 million in the first quarter of the previous year.

Analysts polled by Thomson Reuters Eikon were counting on $259.78 million in earnings.

Meanwhile the Quebec financial institution has not yet signed a new contract with more than 1,000 unionized employees whose collective agreement expired on December 31, 2017.

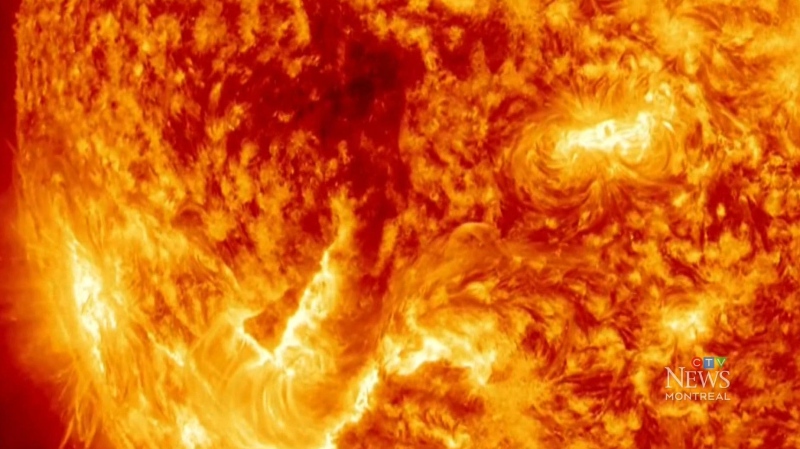

According to Laurentian CEO Francois Desjardins, the bank's performance in the first quarter was affected by lower revenues from the financial markets sector. Market volatility at the end of 2018 weighed on the quarterly results of several Canadian banks.