'I would give my left arm to get 1.69 per cent again': Montrealers bracing for interest rate change

More than two million Canadians will renew their mortgages over the next year-and-a-half. CTV News asked more than 50 mortgage brokers across Canada how to get the best mortgage deal. This is what we found.

Jamie Goren expects when he renews his mortgage in November he might be paying more than ever before.

He moved into his Dollard-des-Ormeaux home in 2002 with a rate of 4.35 per cent. For the last four years, it’s been 1.69 per cent.

"I would give my left arm to get 1.69 per cent again," he said in an interview with CTV News. "I'd even be thrilled to get double 1.69 per cent, but I don't even see that happening."

He recently received a letter from Scotiabank saying it is offering 5.09 per cent. Goren expects that could cost his thousands more every year.

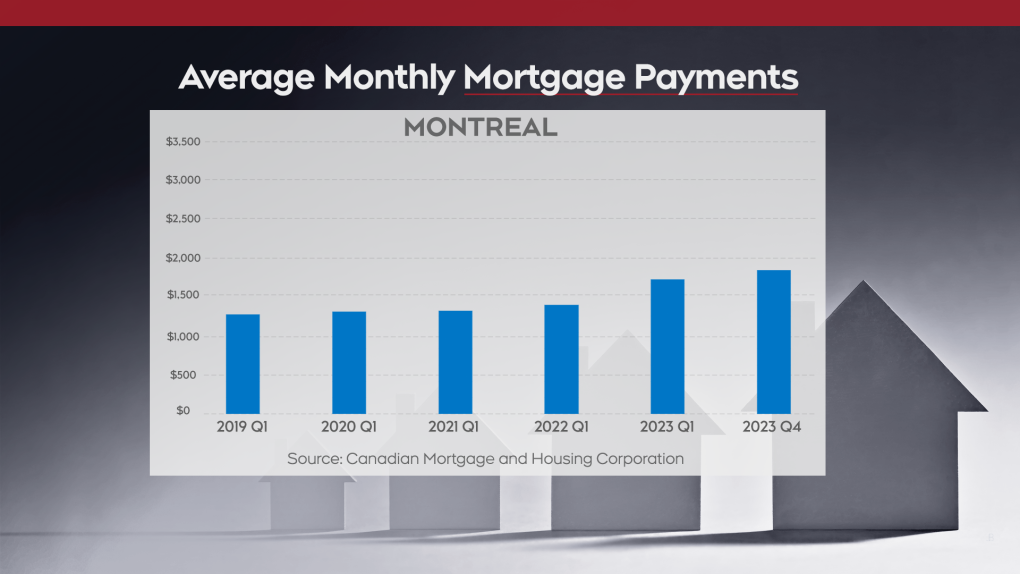

Monthly mortgage payments in Montreal are now more than $1,500. Broker Brad Weigensberg says he’s seeing more cases of people struggling to keep up with payments.

"A lot of what we're seeing now is people that are trying to buy homes, especially young people, working two or three jobs," he said.

According to a CTV News survey of Quebec mortgage brokers, the best rates they could find for a fixed mortgage is 4.69 per cent and 6.5 per cent for a variable mortgage. In 2023, Quebec had more than 75,000 home sales.

Average monthly mortgage payments for Montreal. (CTV News)

Average monthly mortgage payments for Montreal. (CTV News)

While the market has cooled, there is still strong demand for homes under a certain price, Weigensberg said.

"Homes here in Quebec under $450,000 are still going to increase because the demand is there. We're having a lot of immigration come in and people need homes. The upper echelon homes have stalled, the values have stalled," he said.

(Gary Monson / CTV News Graphics)

(Gary Monson / CTV News Graphics)

Goren, like many other Quebec homeowners, is now concerned about how much the Bank of Canada interest rates will cost him.

"At the same time taxes are going up, groceries are going up and the cost of living has never been higher," he said.

Responses to CTV News' Mortgage Broker Questionnaire

Broker Name: Brad Weigensberg

Broker Company: Rise Mortgages (division of Mortgage Architect)

Note: All questions are based on a typical Canadian household renewing a mortgage.

Question #1: What is the best type of mortgage to have right now and for how long?

| VARIABLE RATE | FIXED RATE | IT DEPENDS |

| 3 years fixed |

There is no right answer to the variable or fixed option, both options are bad options given the hopeful reduction in rates in the next 3-4 months. Clients can take a variable and hope to lock into a 3-year closed at 4.49% or so in 6 months once rates reduce, but at variable at prime -1% or so (6.20 vs 4.99%-5.19%).

Question #2: What is the best rate you can get right now? (Specify rate and term length)

| VARIABLE RATE | FIXED RATE | IT DEPENDS |

| prime – 1.05% on insured | 4.99% 3 year or 4.69% 5 years insured |

Currently there is a variance of 0.30-0.80 depending on lenders from insured to conventional deals. Give the banks increasing their cash supplies to cover delinquencies and foreclosures, the cost of a conventional deal vs insured is at an all time high. On insured deals, the bank is backed by the insurer who guarantees the value of the property, so they can lend with confidence.

Question #3: Should I get out of my variable mortgage if I have one?

| YES | NO | IT DEPENDS |

| X |

All depends on your rate. If you have prime – 1% or more, then staying in variable is an option as you are close to a rate in the low 6 to high 5. If you are at anything higher, it depends on the rate your bank offers as switching banks can have a big penalty as 3 months interest at 6.5% or so is big.

Question #4: Should I opt for a longer amortization period?

| YES | NO | IT DEPENDS |

| X |

With the current mortgage shock payments happening, extended amortization allows you to safely have a monthly payment you can manage but gives you the options of pre-payment or increasing your payments to offset the longer amortization.

This also will allow you -- when the higher rates are lowered and you’re at renewal -- to continue with the new payment you are used to and that will cut time off the amortization in 3 to 5 years vs. trying to be a hero now and ending up with credit card or line of credit debts which are much higher.

Question #5: Can I trust a bank for mortgage renewal advice?

| YES | NO | IT DEPENDS |

| X |

All advice is simply that -- advice. There is no guarantee to the advice given unless all parties agree that the direction given should be the right decision in the long run. Experience by some advisers is also a huge question mark.

Question #6: What piece of advice would you pass on to anyone looking to renew their mortgage?

Do not simply take your current lender's offer. First, look at the rate offer and see if it's comparable with the current market offers, then see if you can afford that payment or if you need to extend the amortization to make your payments more affordable.

Given that OFSI set out stress tests in the past at 4.79% - 5.25% from 2018-2022 and clients could go up to 44% debt load (monthly payments vs. income) and now rates are above the stress test rate of 5.25% with higher income clients taking home only 50% after tax income, the 6% left to fulfill debts not calculated in the equation (gas, food, insurance, 50% of condo fees in most cases, cell phone, entertainment, internet, drinks, clothes) most Canadians will be forced to borrow on cards and other means, which will increase Canadian household debts. Given the new stress test, most people won't qualify to refinance and re amortize.

CTVNews.ca Top Stories

30% of town structures destroyed in Jasper wildfire: officials

Alberta Premier Danielle Smith is set to tour the resort town of Jasper to see firsthand the devastation caused by wildfires.

'He was just gone': Police ramp up search for vulnerable 3-year-old boy in Mississauga, Ont.

Police in Mississauga are conducting a full-scale search of the city’s biggest park for a non-verbal toddler who went missing Thursday evening. Sgt. Jennifer Trimble told reporters Friday morning that there has been no trace of three-year-old Zaid Abdullah since 6:20 p.m., when he was last seen with his parents in Erindale Park, near Dundas Street West and Mississauga Road.

Driver charged after flashing high beams at approaching police

Orillia OPP arrested and charged a driver with impaired driving after flashing their high beams.

At least 4 buildings burned at Jasper Park Lodge, others damaged: Fairmont memo

The Fairmont Jasper Park Lodge said Thursday afternoon most of its structures are 'standing and intact,' including its iconic main lodge.

Canada's Christine Sinclair: 'We were never shown drone footage'

Canada soccer great Christine Sinclair said on Friday national team players were never shown drone footage during the more than two decades she was on the team, following a spying scandal that cast a shadow over the Canadians at the Paris Games.

Winnipeg senior's account overdrawn $146,000 for water bill

A Winnipeg senior is getting soaked with a six figure water bill.

Irish museum pulls Sinead O'Connor waxwork after just one day due to backlash

An Irish museum will withdraw a waxwork of singer-songwriter Sinéad O’Connor just one day after installing it, following a backlash from her family and the public, it told CNN in a statement on Friday.

Paris Olympics kicks off with ambitious but rainy opening ceremony on the Seine River

Celebrating its reputation as a cradle of revolution, Paris kicked off its first Summer Olympics in a century on Friday with a rain-soaked, rule-breaking opening ceremony studded with stars and fantasy along the Seine River.

Major Canadian bank experiences direct deposit outage on payday

Scotiabank says it has fixed a technical issue that impacted direct deposits on Friday morning.