Laurentian Bank launches strategic review that could lead to sale

The Banque Laurentienne or Laurentian Bank logo is pictured in Montreal on June 21, 2016. THE CANADIAN PRESS/Paul Chiasson

The Banque Laurentienne or Laurentian Bank logo is pictured in Montreal on June 21, 2016. THE CANADIAN PRESS/Paul Chiasson

Laurentian Bank is launching a strategic review process that could lead to the sale of the regional bank.

The financial institution, officially based in Montreal but managed from Toronto, made the announcement in a press release after market close on Tuesday. The bank does not intend to communicate any further information on this subject until the review is completed.

Laurentian Bank has been in talks with several bidders since the end of June, according to four sources quoted by the Globe and Mail.

President and CEO Rania Llewellyn launched a new strategic plan at the end of 2021 to breathe new life into a bank that was losing momentum after the failure of the seven-year transformation plan adopted by her predecessor, François Desjardins, in 2015.

In a banking industry dominated by large financial institutions, Laurentian's size represented a drag, as technological investments are often as significant as for a large institution, but are spread over a smaller customer base.

The bank has made progress under Llewellyn's leadership. In an interview in April, she pointed out that the institution was ahead of schedule in terms of its strategic plan.

The bank has a mobile application, its processes are faster, and customer and employee satisfaction is up. This progress is also reflected in the financial results. Earnings per share have risen by 14% in 2022, compared with an initial target growth of 5%.

Unfavourable winds are blowing through the financial industry, however, against a backdrop of rising interest rates and economic uncertainty. In June, the bank announced a 17% decline in net income, although less than had been feared by financial analysts. It also announced a rationalization of its capital markets activities.

Other layoffs were announced recently, notably at Mouvement Desjardins and Bank of Montreal.

Founded in Montreal in 1846, Laurentian Bank has almost 3,000 employees and had a market value of around $1.5 billion before the strategic review process was announced.

The last major transaction in the Canadian banking sector occurred in November 2022, when RBC Bank announced its intention to acquire HSBC's Canadian operations for $13.5 billion. The transaction has yet to receive regulatory approval.

The federal government announced on Tuesday that it was extending its consultation process until July 21.

This report by The Canadian Press was first published in French on July 11, 2023.

CTVNews.ca Top Stories

'A beautiful soul': Funeral held for baby boy killed in wrong-way crash on Highway 401

A funeral was held on Wednesday for a three-month-old boy who died after being involved in a wrong-way crash on Highway 401 in Whitby last week.

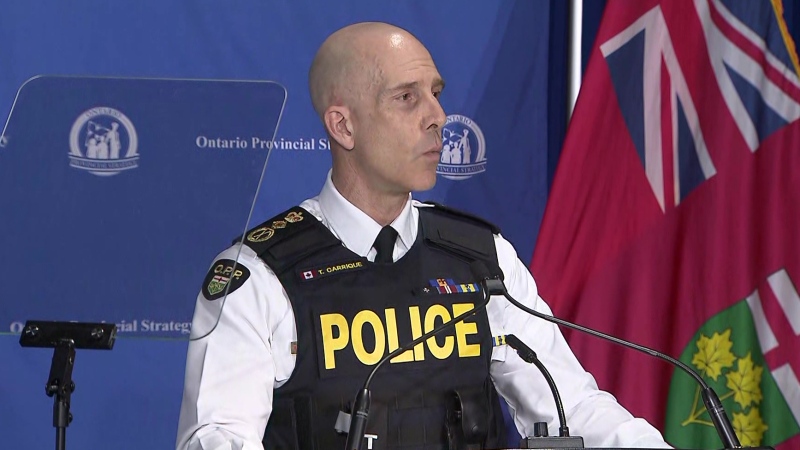

'Sophisticated' cyberattacks detected on B.C. government networks, premier says

There has been a "sophisticated" cybersecurity breach detected on B.C. government networks, Premier David Eby confirmed Wednesday evening.

Police handcuff man trying to enter Drake's Toronto mansion

Toronto police say a man was taken into custody outside Drake's Bridle Path mansion Wednesday afternoon after he tried to gain access to the residence.

Biden says he will stop sending bombs and artillery shells to Israel if they launch major invasion of Rafah

U.S. President Joe Biden said for the first time Wednesday he would halt shipments of American weapons to Israel, which he acknowledged have been used to kill civilians in Gaza, if Prime Minister Benjamin Netanyahu orders a major invasion of the city of Rafah.

Rookie goalie Arturs Silovs to start for Canucks in Game 1 vs. Oilers

Rookie goalie Arturs Silovs will start in net for the Canucks as Vancouver kicks off a second-round series against the Edmonton Oilers Wednesday night.

Nijjar murder suspect says he had Canadian study permit in immigration firm's video

One of the Indian nationals accused of murdering British Columbia Sikh activist Hardeep Singh Nijjar says in a social media video that he received a Canadian study permit with the help of an Indian immigration consultancy.

Pfizer agrees to settle more than 10K lawsuits over Zantac cancer risk: Bloomberg News

Pfizer has agreed to settle more than 10,000 lawsuits about cancer risks related to the now discontinued heartburn drug Zantac, Bloomberg News reported on Wednesday, citing people familiar with the deal.

Quebec premier defends new museum on Quebecois nation after Indigenous criticism

Quebec Premier Francois Legault is defending his comments about a new history museum after he was accused by a prominent First Nations group of trying to erase their history.

U.S. presidential candidate RFK Jr. had a brain worm, has recovered, campaign says

Independent U.S. presidential candidate Robert F. Kennedy Jr. had a parasite in his brain more than a decade ago, but has fully recovered, his campaign said, after the New York Times reported about the ailment.