CAQ's promised tax cuts disadvantage those with lower incomes, says research group

The less affluent are disadvantaged by the Legault government's promised tax cuts, according to a report from the Institut de recherche et d'informations socioéconomiques (IRIS), which recommends instead allocating this money to public services.

The promised cut would save $814 for taxpayers earning more than $100,000 a year, according to the left-wing think tank. The savings are $378 for a taxpayer making $55,000.

Nearly 35 per cent of Quebec's population will not earn enough income to benefit from the tax break.

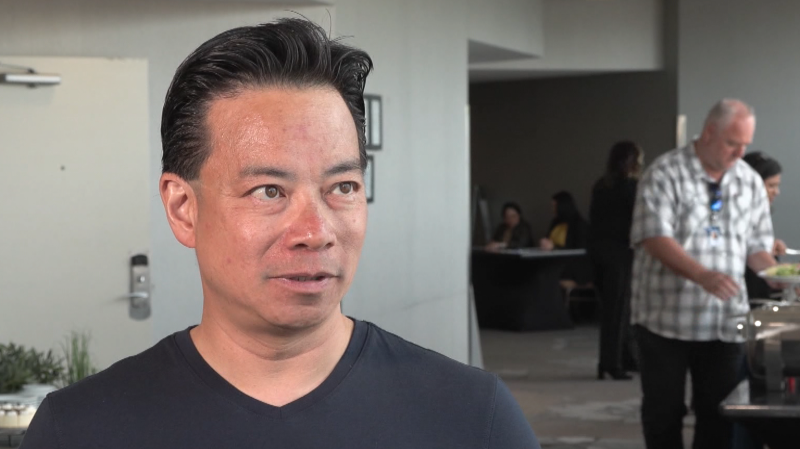

"It would be an unfair tax cut because it would mainly favour taxpayers with higher incomes," said researcher Guillaume Hébert in an interview.

The Legault government has promised to reduce the tax rate of the first two levels by one percentage point. The nearly $2 billion-tax measure will be financed by reducing payments to the Generations Fund.

Hébert agrees with the idea of reviewing the payments to the Generations Fund, which he compares to "a straitjacket" that "hides" budget surpluses to limit government spending, he said.

According to IRIS, the money allocated to tax cuts should instead be used to finance public services like education and health.

Hébert cites staffing issues in the health network, the needs in the home services sector for seniors, and the lack of daycare spots.

"Public services are already in bad shape," he said.

"Labour scarcity is often scarcity at the price employers would want to pay," he added.

"When you value jobs enough, when you have workplaces that are attractive, that don't cause a completely exaggerated percentage of staff to burn out, you are able to get people and retain [public sector employees]."

TAX CUT: MIXED REACTIONS

The promised tax cut is not unanimously supported, and its critics have made several public appearances in the run-up to the next provincial budget, expected to be adopted on March 21.

For various reasons, economists, civil society groups and unions have called on Finance Minister Eric Girard to abandon the election promise of the Coalition avenir Québec (CAQ).

Some argue for additional investment in public services, while others would like to see continued payments to the Generations Fund to continue reducing public debt.

But tax relief also has its advocates: the Canadian Federation of Independent Business (CFIB) publicly urged the government to keep its election promise.

"We talk about intergenerational equity, but ensuring a more advantageous tax burden for young people is also intergenerational equity," said François Vincent, CFIB's Quebec vice president, in an interview. "That we remain the most taxed is not necessarily the best thing."

MORE TAXED THAN ONTARIO?

Girard had defended the planned tax cut, pointing out that the Quebec middle class was more taxed than in Ontario.

"It's not someone who earns $300,000 who pays more tax than in Ontario, all things considered. It's at $70,000 of income that you pay 36 per cent more tax in Quebec than in Ontario," he said at a conference before Montreal's trade board in December.

But comparing taxes with other provinces doesn't provide the whole picture, says Hébert.

"You have to be careful before you say that Quebecers are the most taxed in North America."

Each household's situation will impact its effective tax rate when transfers to families are considered, for example.

"You have to look at different types of households to see how their tax rate changes. You also have to look at the benefits that people receive, especially families.

"We see that for a single mother or a family with average incomes with two children, the tax rate drops dramatically and puts Quebec among the places where it's most advantageous, where taxes are the least burdensome."

This report by The Canadian Press was first published in French on March 15, 2023.

CTVNews.ca Top Stories

'Most of the city is evacuating': Gridlock on Alberta highway after evacuation order in Fort McMurray

Four Fort McMurray neighbourhoods were ordered to evacuate on Tuesday as a wildfire gets closer to the city.

Sask. police seize 1.5M pieces of evidence, lay 60 more charges in child exploitation case

Saskatchewan RCMP have revealed that a historic sexual assault investigation has led to the discovery of alleged crimes against children dating back to 2005.

'Inappropriate' behaviour shuts down Dublin to New York City portal

Less than a week after two public sculptures featuring a livestream between Dublin, Ireland, and New York City debuted, 'inappropriate behaviour' in real-time interactions between people in the two cities has prompted a temporary shutdown.

Oilers starting Calvin Pickard in goal for Game 4 vs. Canucks

The Edmonton Oilers will start Calvin Pickard in net Tuesday for Game 4 of their playoff series with the Vancouver Canucks.

Chiefs kicker Harrison Butker rails against Pride month, working women in commencement speech

Kansas City Chiefs kicker Harrison Butker railed against Pride month, working women, President Biden's leadership during the COVID-19 pandemic and abortion during a commencement address at Benedictine College last weekend.

King Charles III unveils his first official portrait since his coronation

King Charles III has unveiled the first portrait of the monarch completed since he assumed the throne, a vivid image that depicts him in the bright red uniform of the Welsh Guards against a background of similar hues.

Full List Are these Canada's best restaurants? Annual top 100 list revealed

The annual list of Canada's top restaurants in the country was just released and here are the places that made the 2024 cut.

Alberta announces the 4 health agencies that will replace AHS later this year

The province has released more information on its plan to break up Alberta Health Services and replace it with four sector-based health agencies.

Biden administration moving ahead on US$1 billion arms package for Israel, AP sources say

The Biden administration has told key lawmakers it is sending a new package of more than US$1 billion in arms and ammunition to Israel, two congressional aides said Tuesday.