Quebec Finance Minister Eric Girard presented his fifth budget on Tuesday, for the province's 2023-24 fiscal year. Here are some highlights:

-

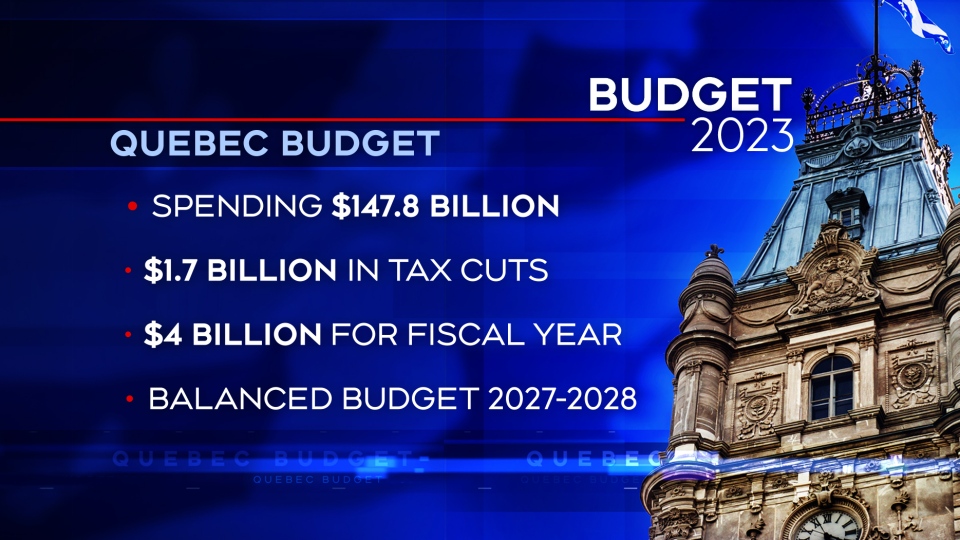

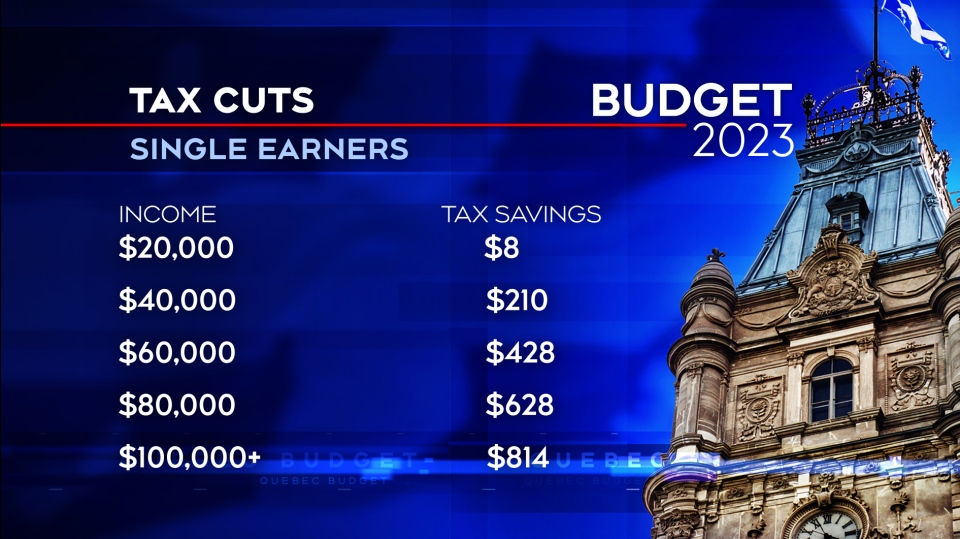

Income tax cuts of one percentage point on the first two income tax brackets, starting in 2023, which will save a single earner up to $814 per year.

-

GDP growth is projected to fall to 0.6 per cent in 2023 from 2.8 per cent in 2022, before rising to 1.4 per cent in 2024.

-

Government spending will be about $148 billion in the 2023-24 fiscal year, with a deficit of about $1.6 billion. The deficit rises to $4 billion after accounting for legally required payments into a fund dedicated to paying down debt.

-

The budget is projected to be balanced in 2027-28, when payments into the debt fund are considered. The budget would be balanced as early as the 2025-26 fiscal year excluding those payments.

- Starting Jan. 1, 2024, Quebecers over the age of 65 who are in the workforce will have the option to stop paying into the Quebec pension plan, which will increase their after-tax income.

LISTEN on CJAD 800 Radio: Quebec budget included long promised tax cuts. Who really benefits?

-

Health-care spending rises by 7.7 per cent, for a total of about $59 billion -- the largest government expenditure.

-

Education spending rises by six per cent, for a total of about $20 billion.

-

Spending of $649 million by the 2027-28 fiscal year for the promotion of the French language.

-

Quebec will receive about $14 billion in equalization payments in the 2023-24 fiscal year, an increase of 2.7 per cent.

-

Federal transfers will be about $30 billion, up 1.8 per cent, including about $8.7 billion for health care, which is 22 per cent more than in the previous fiscal year.

-

Debt service will be about $9.5 billion, a drop of about six per cent from the prior fiscal year.

- Quebec's gross debt by March 31, 2023, will be about $223 billion, and its gross debt-to-GDP ratio will be 40.2 per cent.

LISTEN on CJAD 800 Radio: What are you getting from the Quebec budget?

This report by The Canadian Press was first published on March 21, 2023