MONTREAL -- The pandemic has left people exposed to more than just a virus, especially with everyone doing everything -- shopping, working, and most else -- from home.

Being online so much also leaves people vulnerable to scams. The Canadian Anti-Fraud Centre reports that fraud are on the rise, saying that since March of last year, Canadians filed nearly 70,000 fraud reports totalling more than $100 million in reported losses.

February was Fraud Prevention Month, and a number of authorities tried to alert people to how to spot fraudulent schemes.

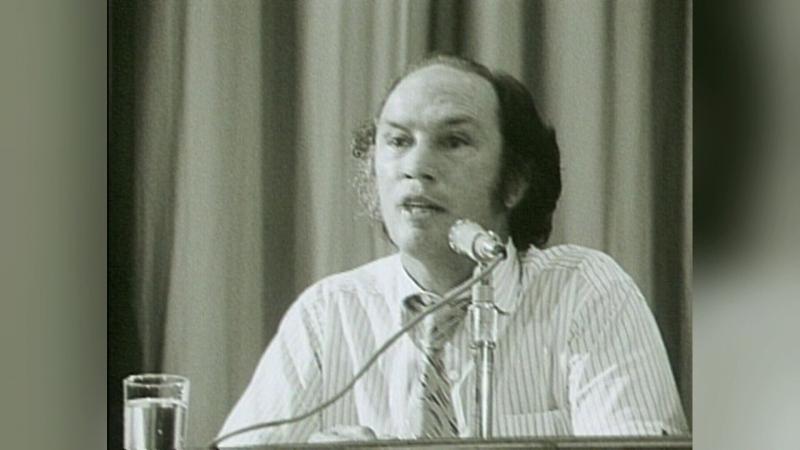

“The fraudsters are using any means at their disposal to target Canadians," says RCMP intelligence analyst Jeff Thomson.

Anyone can be a victim, he said. "They really don’t discriminate who they’re targeting."

Phone scams are alive and well, and also online shopping scams, he said.

“People are hopping online to buy goods and services, landing on deceptive, fraudulent web pages, where they’d buy good that ended up being counterfeit or they didn’t receive anything at all," he said.

Quebec provincial police have also launched an awareness campaign, “Smell the Scam.”

They say many fraudulent schemes currently playing out in Quebec are directly tied to the pandemic, such as one where people pay for puppies online but never receive them.

“Quebec ranks second in terms of the number of frauds, after Ontario," said Catherine Bernard, a spokesperson for provincial police.

Thomson said to beware of suspicious calls or messages that purport to be from the government, especially the Canadian Revenue Agency.

“Earlier on in the pandemic what we saw were text messages designed to look like the Government of Canada, asking people to click on links to deposit their CERB benefits,” he said.

The centre is also seeing an uptick in phishing, where fraud artists use texts or emails that appear to be from trusted organizations, to convince people to update their profiles and give away personal information.

A recent survey by Nielson for the chartered professional accountants of Canada (CPA) found nearly three-quarters of Canadians have received fraudulent messages, and one-third have been victims of fraud.

Another survey Leger commissioned by payment processing company Moneris found that since the start of the COVID-19 pandemic, 38 per cent of Canadians experienced potential fraud or engaged in behaviour that could expose them to fraud.

The problem can also come from things that seem relatively simple: nearly one quarter (23 per cent) reported that they provided their credit card number over the phone to a store or restaurant, which Moneris says is a a high-risk activity for both consumers and businesses.

"Canadians are eager to support local businesses impacted by pandemic restrictions, but often unknowingly put themselves and the business at greater risk for fraud by paying over the phone," said Brian Prentice, Chief Risk Officer for Moneris.

"When a business can't prove it is transacting with the actual cardholder, there is no chargeback protection for the business and the transaction is subject to higher processing fees to offset the risk.”

If a secure website isn’t an option, curbside pickup is the safer way to go, he said.

The CPA recommends using caution during online activities, never answer calls or texts from unknown numbers, and check your bank and credit card statements regularly.

Thomson says a good rule of thumb is that if it sounds urgent, coercive, threatening, or too good to be true, slow down and don’t react.

“It’s a numbers game at the end of the day -- the more people they hit the more likely they are to get victims on the line," he said.

If you believe you've been a victim of fraud you should contact your local police station and report it to the Canadian Anti-Fraud Center at 1-888-495-8501.