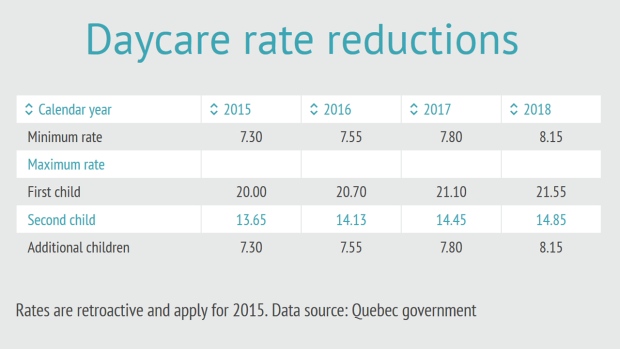

There will be a 50 per cent reduction in the extra daycare contribution for the second child in a family who is attending a subsidized daycare.

The health contribution, introduced in 2010, will be gradually phased out. It will be eliminated for low-income earners in 2017 and completely eliminated by 2018. As of 2016, the maximum amount for the first two levels of the health contribution will be reduced from $100 to $50 for the first level (income of $41,265 or less), $200 to $175 for the second level (incomes range from $41,265 to $134,095). This measure is expected to affect 4.3 million taxpayers who will benefit from $130 million in tax relief in 2016-2017.

The government is promoting eco-friendly home renovations with a new tax credit. The hope is the move will help reduce greenhouse gas emissions. The RénoVert refundable tax credit will equal 20 per cent of eligible home renovation expenditures worth between $2,500 and $52,500, making the maximum value of the credit $10,000. The eligibility period ends March 31, 2017.

Quebec wants older workers to stay active in the labour market longer, or re-enter the labour market after they leave. To do that, a tax credit that eliminates income tax payable for a portion of work income that exceeds $5,000, currently available to those 65 and up, will be available for those who are 63 and up in 2017. The portion of eligible income will go up by $2,000 every year, up to a maximum of $10,000 in 2018.

Also, starting in 2018 workers 62 years old and up will be eligible for a tax credit for “experienced workers,” giving them tax relief on earnings in excess of $4,000 per year.