Claudio and Anne-Marie Riti are among the 700,000 Quebecers who visit the United States each winter and now have to tackle an intimidating U.S. tax form.

The Ritis will have to fill out a detailed report to the United States tax authority offering information about time spent in the United States.

The couple, who own a condo in Florida, fear that the process could rob them of the peace of mind they seek by fleeing the winter weather from January to April.

Those who fail to fill out the 8840 form could be subject to fines of $10,000.

"The whole purpose of going down to Florida is to be in a relaxing environment," said Claudio Riti.

The form aims to determine whether a person has closer ties to the U.S. or Canada and asks where each person banks and where they pay their taxes, among other queries.

Some say it's not an easy form to navigate.

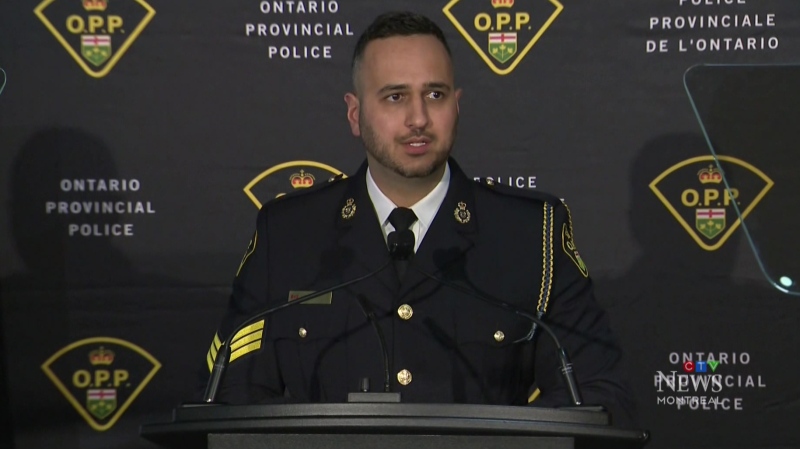

"There is that mathematical formula that needs to be mentioned and believe me it has put the fear of god into a lot of people. My phone has been ringing off the hook," said Jim Leroux, Quebec president of the Canadian Snowbirds Association.

"The Americans seem to be looking for any additional revenue that they can find," said legal analyst Jordan Charness.

To fill it out, one must calculate the total number of days one has spent in the U.S. for the last year, add one-third of that sum to the total days in the U.S. the previous year, and then add on one-sixth of the total from the year prior.

Anyone with more than 182 days in the U.S., according to the formula, must fill out the form.

Those who should have filled out the tax form and do not could be fined.

"You might be subject to a penalty which is $10,000," Charness said.

Canadians can stay in the U.S. for up to 180 days each year without a visa, but that arrangement with the Immigration department does not concern the IRS.

Those who spend less than 120 days in the United States, according to the formula, and consider themselves Canadian and live in Canada shouldn't have to worry.

The Ritis are worried that the results of their paperwork could fall into the wrong hands.

"Look at what happens across the world. I mean anyone can take hold of this information and do whatever they want," said Annie-Marie Riti.