The latest Royal Lepage report on Canadian real estate shows new mortgage rules have discouraged many first-time buyers.

It's also predicting slower growth in the Canadian housing market for this year.

It may not seem that way in Montreal, however, where scores of condominiums are being built in Griffintown and the downtown area, including the most famous one outside the Bell Centre.

In 2010, condo prices in Montreal rose by 9 per cent. In 2011, they rose another 4 per cent, and in the first nine months of 2012, they jumped yet another 4 per cent.

That’s all been good news for real estate agent Tatiana Londono of the Londono Realty Group.

“These new construction condos, they're going for $600, $700, even $1,000 per square foot, so that is crazy,” said Londono.

In the past year, however, 12,000 new condo units were built, creating real fears the market is at least softening.

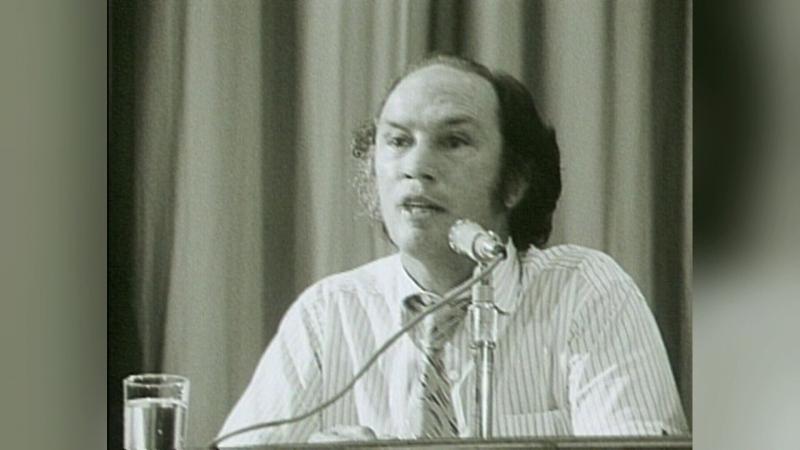

“There are a lot of listings and the growth of the listings has outpaced the growth of demand,” said Bertrand Recher, an analyst for the Canada Mortgage and Housing Corporation.

That growth comes in spite of good demographics for the condo market, including many single people living alone and aging baby boomers looking to downsize.

It has the CMHC predicting flat to negative growth in the condo market in the coming year.

“The bubble is not going to burst, per se, the bubble may diffuse over a period of time,” said Harjeet Bhabra, finance professor at the John Molson School of Business.