Q & A: Tax specialist explains what Quebec Budget 2023-2024 means for you

CTV News Montreal's Caroline Van Vlaardingen spoke to BDO Canada tax partner Ernie Furt about what Quebec's new budget means for taxpayers. You can watch the full interview above and read the full transcript below.

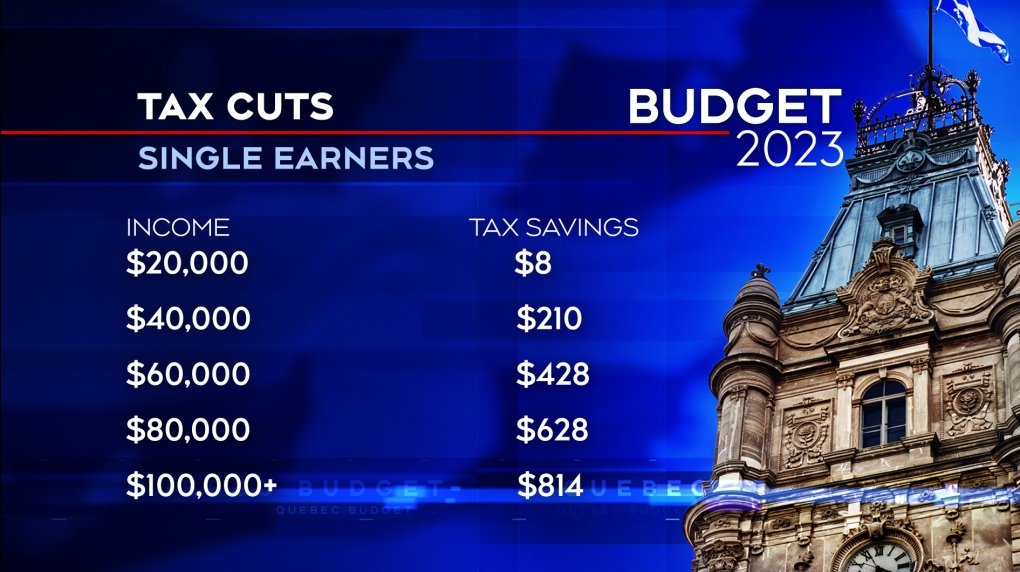

Caroline Van Vlaardingen: So, Ernie, the finance minister is calling it the most important tax cut in recent history of Quebec, or in the history of Quebec—4.6 million Quebecers will see tax cuts. Let's talk again about what it will represent for individuals and couples.

Ernie Furt: Well, let's take a look at different taxable income levels. If you're a single individual earning $40,000, it means $210 to you. If you're a couple earning $40,000, it means $56 to you. At the $100K level, if you're single, it means $814. And if you're a couple, it means $1,627. So, that's pretty good at the end of the day. And the good thing about it is, if you're a higher income earner, you're not clawed back this amount. So, this is a permanent cut. And as long as it remains there and people can earn what they earn, as Eric Girard said, they can benefit from this tax cut.

Quebec budget 2023 tax cuts

Quebec budget 2023 tax cuts

Caroline Van Vlaardingen: So often Quebecers say the more you earn, the more you pay. So, this is kind of nice that it does allow higher income earners, you know, those who earn more, to also benefit from a tax cut. There's something interesting about the QPP Quebec pension plan as well. Let's talk about that for a second. What's going on here?

Ernie Furt: Well, they are encouraging older workers to continue to work. So, currently, if you work and you're over the age of 65, and forever you are paying QPP on your earnings, on a salary or as a self-employed worker. However, starting in January 2024, if you reach the age of 72, you no longer have to pay any QPP on your earnings. That's a $4K amount that you're actually saving if you're earning about $63,100 a year or more. So that's an interesting cut. And if you're self-employed, you can double that. So, that's one thing that they're doing.

Another thing that they're doing is you now are going to be able to have the option to stop paying QPP at age 65, provided you're taking it. You currently do not have that option in Quebec. You do have that option in Canada, but you don't have that option in Quebec.

Now, the last QPP issue that they're doing is, currently, you can take your QPP and defer it up to age 70, where you're getting an increase of 0.5 per cent per month, i.e. a six per cent increase in your baseline QPP payments. So they're allowing you to defer this until age 72, and I didn't see it but it's probably there where this 0.5 per cent increase per month is still going to be there. So if you don't need the money, you don't have to take it, but you have to look at the time value of money and how old you're going to be when you're going to die, but nobody knows that.

Ernie Furt: Quebecers will always be inflamed with something. So, will it? It depends. You know what? Just go out there, do what you got to do, and work. I wish everybody has to pay more taxes next year, because that means you've earned more than the previous year.

LISTEN on CJAD 800 Radio: What are you getting from the Quebec budget?

CTVNews.ca Top Stories

'Canadians deserve a real choice': Justin Trudeau resigning, prorogues Parliament

Prime Minister Justin Trudeau is stepping down as Liberal leader, and is proroguing Parliament as the Liberal Party of Canada embarks on the journey to replace him.

Trudeau resignation: recap key moments, analysis, reaction as it happened

Prime Minister Justin Trudeau has stepped down as Liberal leader. Here's a recap of key moments, analysis, and reaction as it happened.

'Together, what a great nation it would be': Donald Trump, Elon Musk react to Justin Trudeau's resignation

Amid news of Prime Minister Justin Trudeau's resignation as leader of the Liberal party on Monday morning, reactions from prominent figures began piling in.

Justin Trudeau is resigning, what will be his legacy? A look back at key political eras

In a seismic political move, Justin Trudeau has announced his intention to step down as leader of the Liberal Party of Canada and prime minister, once his successor is named. This decision comes after more than nine years in the country's top job and nearly 12 years at the helm of his party.

Trudeau says Parliament is 'prorogued' until March. What does that mean?

In his resignation speech on Monday, Prime Minister Justin Trudeau announced that Parliament would be prorogued until March, which will give the Liberal party time to find a new leader ahead of an expected confidence vote and early election.

Justin Trudeau resignation: Here's what he said in Ottawa today

Prime Minister Justin Trudeau delivered a speech about his political future Monday morning outside Rideau Cottage in Ottawa. Here's the message he delivered to Canadians.

Alberta government signs new oil and gas agreement with Enbridge

The Alberta government has signed an agreement with Enbridge that Premier Danielle Smith says will increase exports of the province's heavy oil to the United States.

Trudeau leaves mixed global legacy as he exits during turbulent time, analysts say

Prime Minister Justin Trudeau will leave the world stage with a legacy of promoting feminist causes and focusing on Asia, along with criticism that Canada's actions fell short of the government's rhetoric.

Judge condemns murder trial delay, asks lawyers to 'turn around' and look at the public 'we serve'

A Saskatoon murder trial opened on Monday with the judge sharply criticizing the time it’s taken to get to trial.