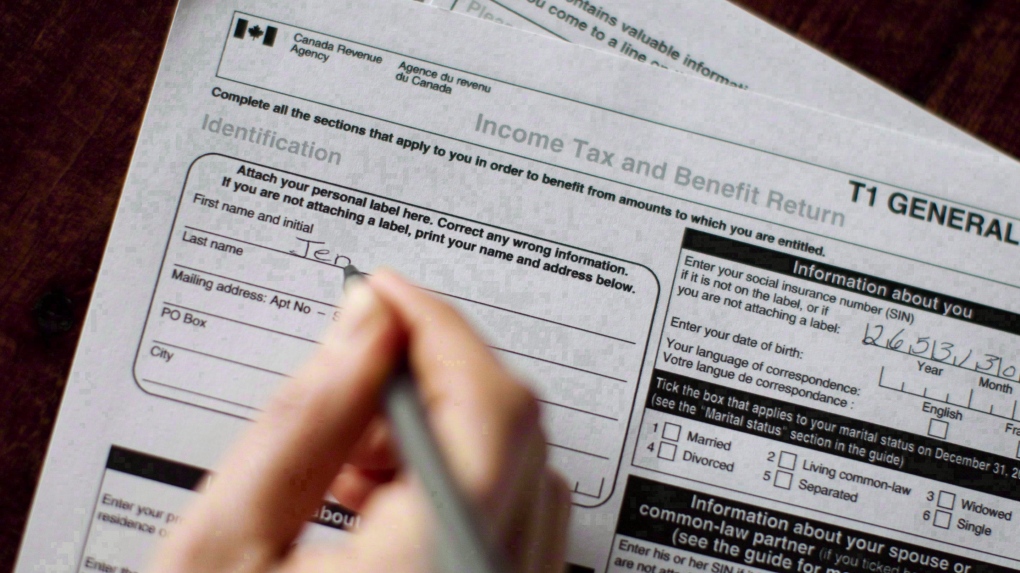

MONTREAL -- Nearly 30 organizations are asking for people who rely on social assistance to be exempt from having to file income tax returns, and that tax credits and other assistance they’re entitled to be automatically paid to them.

In a release published on Tuesday, the many organizations – located across Quebec – reported that just extending the tax-return deadline amid the COVID-19 pandemic is not sufficient help for social assistance recipients.

The organizations said these folks are confronted with several barriers, such as mental health problems, functional limits, and illiteracy. For them, providing a tax return is often really difficult even if it’s essential to access the solidarity credit, housing allowances, the refund of goods and services tax (GST) and the fixing of subsidized rent.

Community organizations don’t have adequate funding to set up tax services, despite receiving requests for help from people on social assistance. If they do decide to help, other activities have to be pushed to the side.

This report by The Canadian Press was first published May 26, 2020.