Retirees from across the country plan to demonstrate on Parliament Hill this Wednesday to demand the government take action to protect their pensions.

They call themselves Nortel Retirees and Former Employee Protection Canada.

Their goal is to have the Bankruptcy and Insolvency Act changed so pensioners are considered secure, so they will have a better chance of getting paid if their employer goes under.

Carl Sinclair, former Nortel employee, is one person who is worried his pension will vanish because the company he devoted decades to filed for bankruptcy protection.

Sinclair lives in the small town of Piopolis, about 250 km east of Montreal.

He bought the land back in 1973, after he started working for Nortel, knowing that was where he wanted to live out his golden years.

Money has never been a problem.

"We were smart enough at our age to set out a budget," said Sinclair.

But the forethought that Sinclair put into his retirement was not matched by his employer.

In January, Nortel filed for bankruptcy protection in the United States.

The company has shortchanged its pension plan by $2.5 to 2.8 billion, and according to Canadian law, pensioners are considered "unsecured" creditors.

Sinclair is one of many former employees worried his retirement planning was all for naught.

"I estimate between 4 and 500 dollars a month left to handle my oil, all my taxes and my school taxes and any miscellaneous," said Carl Sinclair.

That means Sinclair is counting his pennies and skipping hair cuts.

He no longer buys cranberry juice, something his doctors have recommended he drink for his health, simply because it's too expensive.

"With this reduction it's just strictly unfair," said Sinclair.

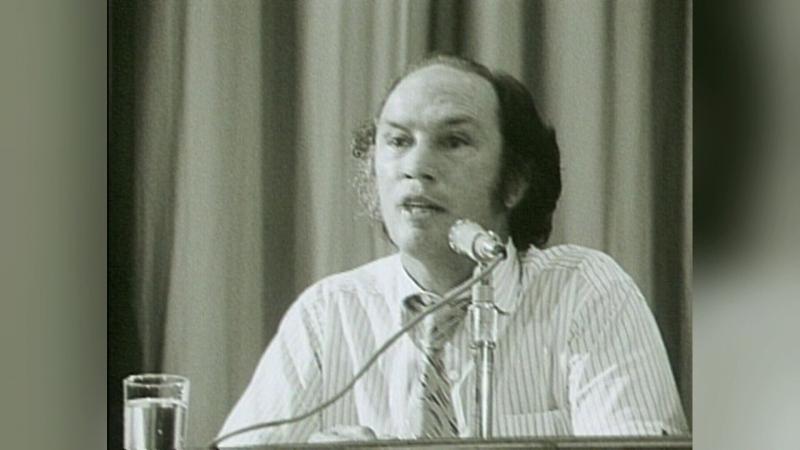

Michel Magnan, an accountant and professor at Concordia's John Molson School of Business, says there is not much people can do if their employer fails to properly fund its pension plan.

"Look at Abitibi Bowater for instance. Let's say you got 7 dollars of assets and 10 dollars of obligations towards employees and retirees, then they have to take a cut," said Magnan.

It's worse when a company declares bankruptcy.

"The pension plan gets terminated and whatever money is in the pension plan is what the employees and the retirees have to split amongst themselves and the law mandates that it be fair and equitable," said Magnan. "The way to protect yourself is actually before it goes bad: make sure the committee who oversees the pension plan is very active."

The Quebec government has offered to help former Nortel workers.

Later this month it will announce that retirees will be able to pull all they are owed out of a pension plan and hand it over to Quebec's Regie des Rentes.

The government would manage the assets by investing them for five years in an attempt to recoup the funding shortfall.

A spokesperson for the labour minister's office says that choice could be offered to retirees from other companies.