Quebec credit card users will have to pay off at least two per cent of their monthly owed balance as new rules came into effect across the province on Thursday.

According to provisions of the Consumer Protection Act, the minimum threshold will then increase by half a percentage point per year starting Aug. 1, 2020 until it reaches five per cent.

For new credit card agreements, the minimum monthly payment will now start at five per cent.

The Office of Consumer Protection said cardholders already required to make a minimum payment of two per cent or more will not be affected by the change this year.

An online calculator was made available to Quebec consumers to figure out the total cost of credit charges and the time it would take to repay debt. By recording different percentages of the balance paid each month, a consumer can see how expensive it would be to stick to the minimum payment.

While the new rules came into effect on Thursday, the changes are due to legislation passed by a Liberal government tin 2017. According to the Credit Counselling Society the average Canadian is carrying $22,000 worth of credit card debt, lines of credit debt and other loan debt.

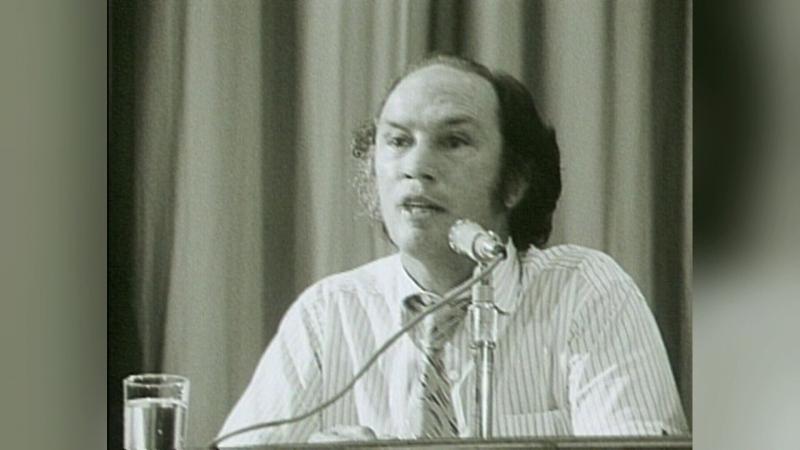

Quebecers carry a particularly high rate of debt, said society spokesperson Scott Hannah.

“One of the things we know is in Quebec, they have a very high rate of insolvency,” he said. “The number of consumers turning to legal solutions like bankruptcy to resolve their debt problems is substantially higher than other provinces. I think the government recognized consumers weren’t taking steps on their own so they had to take steps to bring in the amount of debt consumers have outstanding.”

- With files from CTV News