Montreal’s property values have skyrocketed by an average of 32.4 per cent across the island, according to the Agglomeration of Montreal’s municipal assessment roll for 2023-25.

The average single-family home is now worth $840,000, up from $600,900 during the 2020-22 period.

In Westmount, Outremont, Hampstead, Mount Royal, and Ville-Marie, such homes are valued above $1.5 million, on average. The highest-valued home reached $32.6 million.

Meanwhile, an average apartment now costs $492,400 on the island, up from $365,000 just three years ago — showing a whopping 35 per cent increase.

Among Montreal’s boroughs, property values have gone up the most in Lachine (42.6 per cent), Pierrefonds-Roxboro (40.8 per cent), and Saint-Laurent (39 per cent).

Such hikes were influenced by important industrial parks in Lachine and Saint-Laurent as well as major increases in the West Island’s residential property value, according to the report.

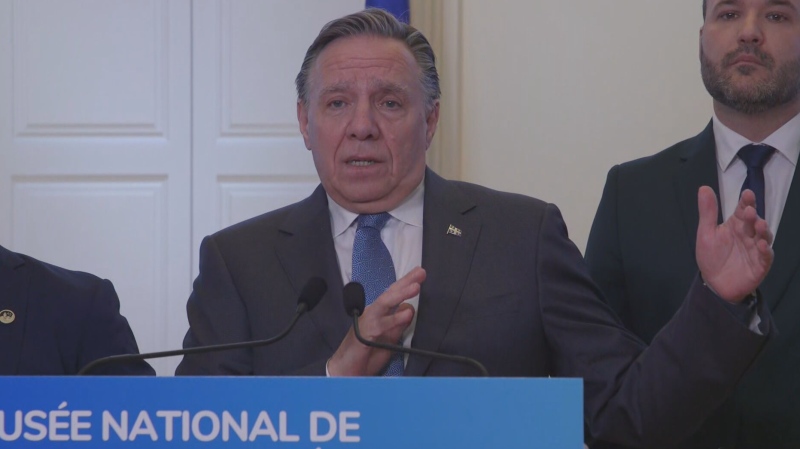

"The good performance of the real estate market demonstrates the enviable economic vitality of Montreal. But the increase in housing prices also brings along a number of concerns for our most vulnerable populations," said Dominique Ollivier, chair of Montreal’s executive committee.

Shopping centres were the only category with a lower valuation than before (-2.1 per cent) as the commercial sector took a significant hit from the COVID-19 pandemic.

HIGHER PROPERTY TAXES?

While property values increased dramatically in the past three years, the city reassured Montrealers that tax hikes won’t be as extreme.

"To witness a significant increase in property values of approximately 32 per cent does not mean that property taxes will increase by 32 per cent," said Ollivier.

"As with each new property tax roll, the city will adjust its tax rate downward so that Montrealers’ tax bills are closer to those of previous years," she added.

Beny Masella, president of the Association of Suburban Municipalities (ASM) and mayor of Montreal West, said he is concerned that his town might have to pay a bigger percentage of the agglomeration bill than other towns and boroughs on the island.

As property values went up by 41.1 per cent in Montreal West, which is nearly 10 per cent above the on-island average, Masella said he believed that common costs should not be shared solely based on this one factor.

"Let’s add in some other factors: how many people are using the transit coming or leaving our towns, how many police stations and fire stations do we have in our towns, how much stuff are we sending to the landfill?" he said.

"The more we use, the more we pay. That’s what’s fair."

But Masella also sees a positive takeaway from the latest figures.

"That’s probably a sign that people prefer to live in the demerged municipalities — and that’s why the house prices are going up more there [...] than in the city of Montreal," he added.

In the meantime, Ollivier said that Montreal’s property owners will not be subject to "additional financial pressure," adding that the city’s revenue will essentially remain the same.

More property tax details will be unveiled during the budget announcement later this year.

The new municipal valuations will come into effect on Jan. 1, 2023.

With files from CTV Montreal’s Max Harrold