MONTREAL -- Some shareholders of Quebec's largest French-language television network, TVA Group, are seeking an investigation into numerous transactions by the network and a proposed $118-million acquisition of a studio company.

The dissident shareholders say the transactions are with various entities controlled by Quebecor Media, Quebecor Inc. and their controlling shareholder Pierre Karl Peladeau.

The shareholders are led by Montreal-based Jarislowsky, Fraser Ltd., which is often outspoken on matters of corporate governance.

Among other things, they say the integration of TVA into the Quebecor Media Group has blurred the lines between the organizations, since some members of senior management are employees of all three companies.

The dissidents said they have filed the request with Quebec's provincial securities regulator, the Autorite des marches financiers.

They have also asked the AMF to require TVA's board to get approval from a majority of the minority shareholders of class B shares, before completing the proposed purchase of the assets of A.R. Global Vision Ltd. and related financing.

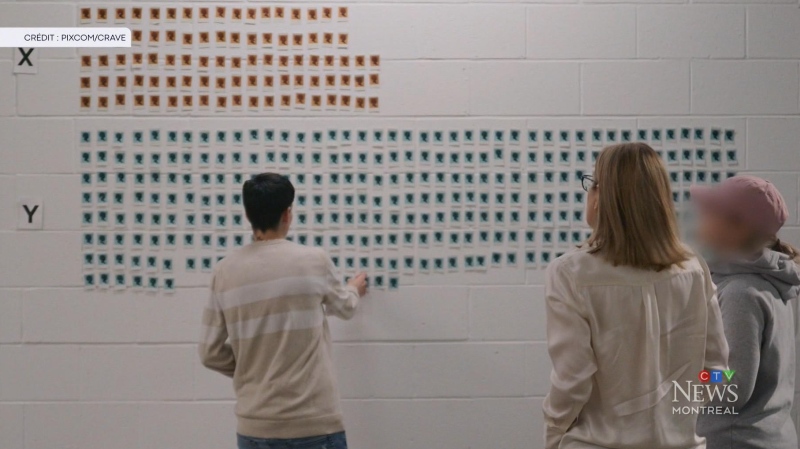

The Vision Globale deal, jointly announced by Quebecor and TVA on Nov. 13, would include soundstages and equipment used for television and movie production.

TVA Group issued a statement in response saying it considers that the arguments of the dissidents are "without merits."

"The corporation would like to reiterate that its strategy has always been to create value for all of TVA's shareholders," it said.