Investment Quebec is bolstering the coffers of Marché Goodfood by investing $10 million in the ready-to-eat food specialist.

The intervention by the Quebec government's financial arm comes at a time when the Montreal-based company's finances are under pressure before it reaches profitability, which management expects to be imminent.

The debt securities acquired by Investissement Québec will have an annual interest rate of 12.5 per cent, the company and the institution announced on Monday.

A group of investors, including officers, directors and shareholders, will provide an additional $2.675 million in capital in the same debt securities.

The capital injection strengthens the company's balance sheet, said Goodfood CEO Jonathan Ferrari.

"With the capital raised, we will continue to take the final steps in our profitable growth plan," the executive said in a statement.

In January, Ferrari reiterated his goal of generating adjusted earnings before interest, taxes, depreciation and amortization (EBITDA) in the current quarter. He did not give a specific timeline for when Goodfood could generate excess cash, but this should occur shortly after achieving positive EBITDA, he said.

Prior to the announcement, Desjardins Capital Markets analyst Frédéric Tremblay believed Goodfood would need new funds before it could finance itself from cash generated from operations.

"I think it would be prudent to consider an infusion of cash in 2023 so that the company is in a better position to finance its growth in the $1 billion-plus ready-to-eat meal industry," he said.

As interest rates have risen, many technology companies have been forced to revise their strategy, while creditors and shareholders have become less patient with growth companies that are not yet profitable.

"This has changed the way we think about the timing of our investments," Ferrari said in January. "Rather than making investments that were going to be profitable in five years, we're now looking at six or 12 months, tops."

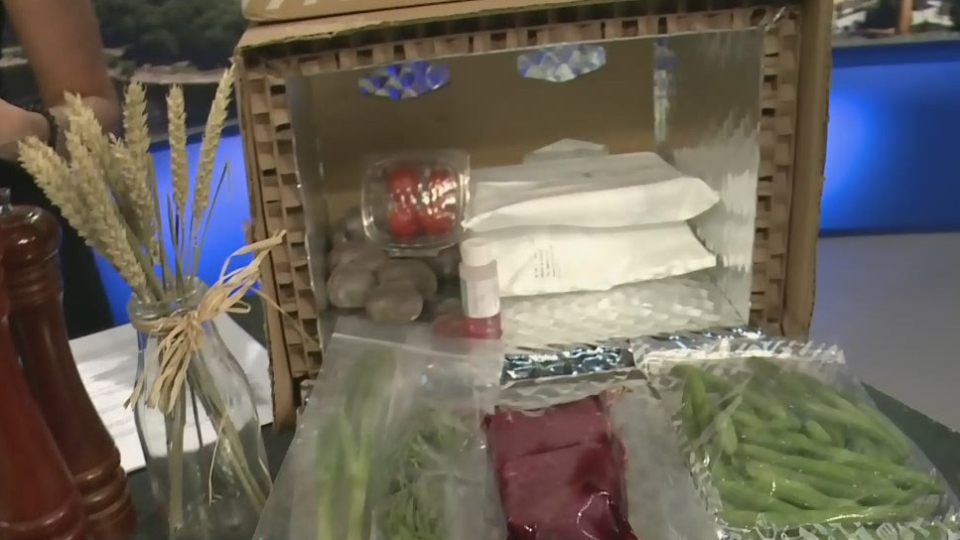

Against this backdrop, Goodfood announced last October that it was abandoning its plans to enter the online grocery market to focus on weekly meal plans where it believes it can achieve profitable growth more quickly.

This report by The Canadian Press was first published in French on Feb. 6, 2023.