MONTREAL -- Alimentation Couche-Tard said Tuesday it is reviewing possible acquisitions in North America and Europe despite volatile economic conditions as it looks to grow its business.

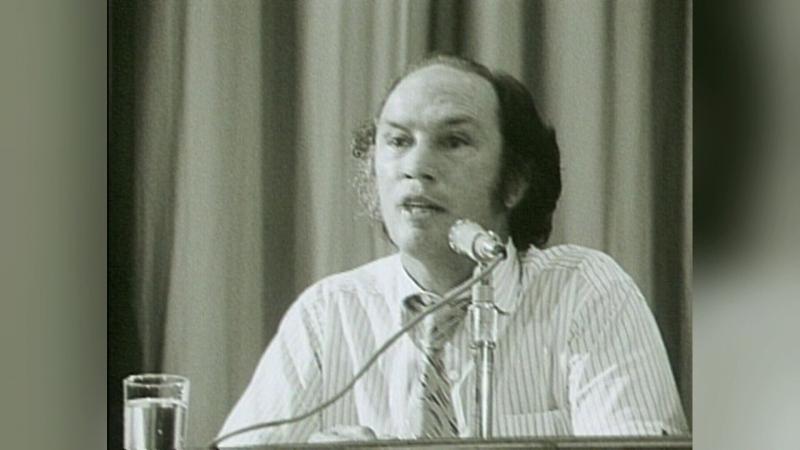

"It's very, very active on both side of the pond," CEO Alain Bouchard said Tuesday during a conference call to discuss its latest financial results.

"We have the capacity to buy all size of business that are coming available right now, so we are well-positioned," he said, declining to identify any potential acquisition targets.

The operator of the Circle K convenience store chain in the United States is seen as a likely bidder to buy the retail assets of oil and gas giant Hess.

Hess announced in May that it will sell its retail, energy marketing and energy trading businesses following pressure from its third-largest shareholder -- activist investor Elliott Management -- to break up the firm. It owns about 1,350 gasoline stations in 16 East Coast states.

Couche-Tard has said it has the capacity to spend $1.5 billion on acquisitions, but hasn't commented on its interest in Hess.

Bouchard described some of the opportunities it is considering as "very good."

"So we hope to be able to announce good news soon."

The Quebec-based company's revenues and profits have surged since it acquired Scandinavia's Statoil Fuel & Retail last June for US$2.58 billion.

However, Couche-Tard shares took a hit Tuesday when it missed expectations for its latest quarter due to higher costs in Europe.

Shares in the convenience store and gas station operator closed down $3.04, or five per cent, at C$58.35 on the Toronto Stock Exchange.

Couche-Tard, which keeps its books in U.S. dollars, reported a profit of US$146.4 million in its latest quarter, or 77 cents per diluted share for the 12 weeks ended April 28 compared with a profit of $117.8 million or 65 cents per share a year ago.

Revenue in what was the fourth quarter of its financial year increased to $8.77 billion, up from $6.05 billion.

However, excluding non-recurring items, Couche-Tard said it earned 61 cents per share, up from 57 cents a year ago.

According to analysts polled by Thomson Reuters, the company had been expected to earn an adjusted per share profit of 77 cents on revenue of $8.9 billion of revenues.

Bouchard said the fourth-quarter profits were slightly lower than previous quarters because of poor weather and higher expenses in Europe.

He said the European business has invested in new IT and planning systems and boosted marketing spending to help new initiatives including a signature fuel brand and fresh food offerings.

The systems rollout, which started in Sweden, should be completed by the end of the 2014 fiscal year.

"We are really enthusiastic about those projects and are happy to see that preliminary data showed that these two new programs seem to deliver the expected results," he said.

Bouchard added the company is getting closer to achieving the cost-cutting targets from its acquisition of Statoil Fuel and Retail.

Couche-Tard realized $11 million in pre-tax synergies and cost savings during the quarter and $28 million for the full year. The savings came from delisting Statoil Fuel & Retail in Europe, the renegotiation of certain agreements with suppliers, the reduction in store costs and the restructuring of certain departments.

Same-store merchandise revenues in the quarter grew 0.1 per cent in the U.S. and 0.9 per cent in Canada. Excluding tobacco products, the increase was two per cent.

U.S. merchandise and service gross profits were down 4.7 per cent to $346.8 million, compared with $363.9 million a year ago reflecting an extra week of business last year. The Canadian gross profit was off 9.1 per cent at $151.3 million, compared with $166.4 million.

Fuel volumes decreased 0.9 per cent in the U.S. and by 4.5 per cent in Canada. The fuel margin was 19.30 cents US per gallon in the U.S., 9.83 cents US per litre in Europe and 6.01 cents Cdn per litre in Canada.

Gross profits on fuel sales grew 14.6 per cent in the U.S. but decreased by 2.2 per cent in Canada.

For its full financial year, Couche-Tard earned US$572.8 million or $3.07 per diluted share on revenue of $25.54 billion. That's up from $22.98 billion the previous year, which included 53 weeks.

Couche-Tard has more than 4,500 company-operated stores in North America and 1,600 locations in Europe.