MONTREAL - Canada's largest pension fund manager, the Caisse de depot et placement du Quebec, reported its net assets grew to $159 billion at the end of 2011 from $151.7 billion a year earlier.

The Montreal-based money manager said Thursday the average return on depositor funds was four per cent.

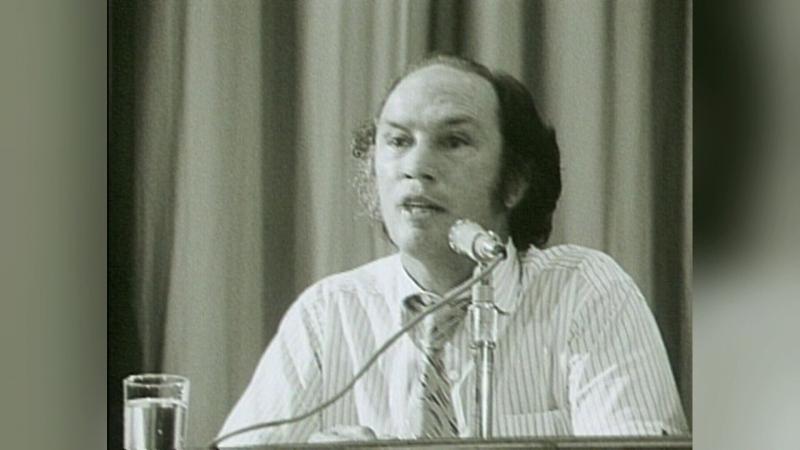

"Since 2009, we have worked on improving our ability to face turbulent markets," said president and CEO Michael Sabia.

"We have simplified our investment strategies, reduced our leverage and developed new tools, thereby enhancing our efficiency and agility.

"In 2011, these efforts served us well. Despite difficult conditions, we were able to adjust our asset allocation to protect our depositors' capital and notably grow our assets."

Net investment income was $5.7 billion, plus $1.5 billion in net deposits.

The Caisse noted that since December 2008 -- during the recession -- its net assets have grown by $38.9 billion and that for the years 2009, 2010 and 2011 its annualized return was 9.1 per cent.

But Sabia also struck a cautious note despite what he called a "solid performance."

"I want to be very clear," he told a news conference. "We're not shouting victory -- far from it. We know we have a lot of hard work ahead of us."

The Caisse has existed since 1965 and its mandate is to increase the funds of its clients, mainly Quebec-based public and private pension funds and insurance plans.

Seven pension funds and insurance plans represent more than 95.5 per cent of the Caisse's depositors.