MONTREAL -- The airport is not what it once was, and some travel agents say their business is down a full 95 per cent.

It’s all a far cry from last summer, when Air Canada seemed to be moving inevitably towards a deal to buy tour operator Air Transat. The agreed price was $18 a share.

Today, though, Air Transat shares are trading at only $6.50.

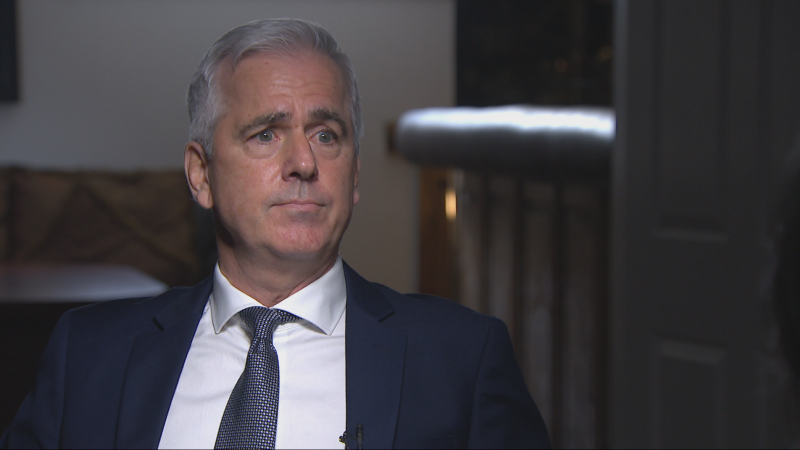

“Looking at it logically, I think Air Canada wants out,” says aviation analyst John Gradek of McGill University.

He thinks Air Canada mostly wanted to buy Transat for its fleet of planes. Now, however, Canada has hundreds of planes parked on the tarmac.

Earlier this year, the Competition Bureau said it had concerns about the proposed takeover, worrying it could lead to higher prices for Canadian travelers.

Again, things have changed: Air Canada is reportedly now lobbying government officials to block the deal, according to a TVA story on Wednesday.

Analysts say it’s no longer worth anywhere close to the $700 million it was before, and the number is probably still falling.

Air Transat wouldn’t comment on the report on Wednesday, but Air Canada issued a statement saying that the only meetings it has had with government relate to the impact of COVID-19, and when it comes to Air Transat, Air Canada simply said it was waiting to hear what regulators decide.

Gradek says that if the deal doesn’t go through, Air Transat could have a big problem. The odds of it surviving right now, without the acquisition, are slim, he said, and te only way out in that case may be a government bailout.