Canadians lose as much as $5 billion per year to credit card and debit card fraud, and most of these thefts could be avoided with simple common sense, says Bob Whitelaw, the former head of the Better Business Bureau.

Tip #1: Don't leave bank receipts lying around.

Shred them and dispose of them or keep them in a safe place.

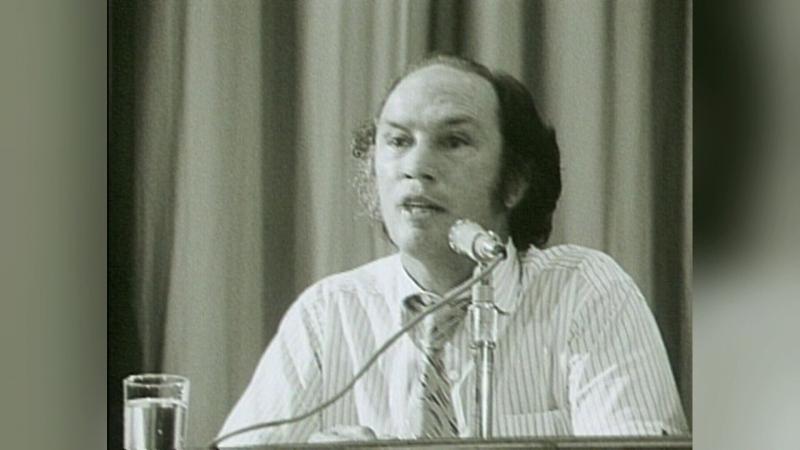

"They can take that piece of intelligence and then put it into a computer system, and that can generate a lot of random numbers. There is a likelihood they can break into your account there, said Whitelaw, now a public policy adviser.

Tip #2: Watch your wallets and purses.

Be vigilant of pickpockets.

"The pickpockets are out there, they're working in crowded environments. They're working when your guard is down, so be aware and hold on (to your valuables)," Whitelaw suggested.

Tip #3: Be careful with online transactions, especially if you use wireless Internet from an unprotected network.

Whitelaw also suggested using a variety of passwords for sensitive sites and bank cards.

"How many people take a password and use it for all their cards?" he said.

Tip #4: Be wary of "stand alone" ATMs found in malls and restaurants.

These machines can be vulnerable to fraud with the use of a splitter.

"Make sure the machine is locked into the wall, the wires are protected and locked you can't see any wires coming out the back," Whitelaw said. "It could be plugged into a reader or a skimmer."

Tip #5: Keep only the essentials in your wallet.

Leave inessential cards, like social insurance cards, in a safe place.

Tip #6: Request photo ID clearance.

Write "Photo ID required" on the back of your credit card, under your signature. This will dissuade a thief from using the card.

Tip #7: Shred it.

If you choose to dispose of your personal papers, including bank receipts and credit card statements, shred them. Would-be thieves look through recycling bins and garbage bags.