Some high-profile restaurateurs are fighting mad, not to mention embarrassed, after being hit with massive tax bills.

Revenue Quebec is accusing several local restaurants of hiding sales.

One of Quebec’s most famous chefs, Normand Laprise, has entered into a nasty battle with Revenue Quebec.

The chef behind Toque and Brasserie T, Laprise insists he’s done nothing wrong at another of his restaurants, Bistro Cocagne, on St-Denis St. Revenue Quebec, however, alleges more than $500,000 was not claimed between 2006 and 2009.

Revenue Quebec is also going after iconic steakhouse Moishes, on St. Laurent Blvd., also for allegedly not paying $500,000 in taxes.

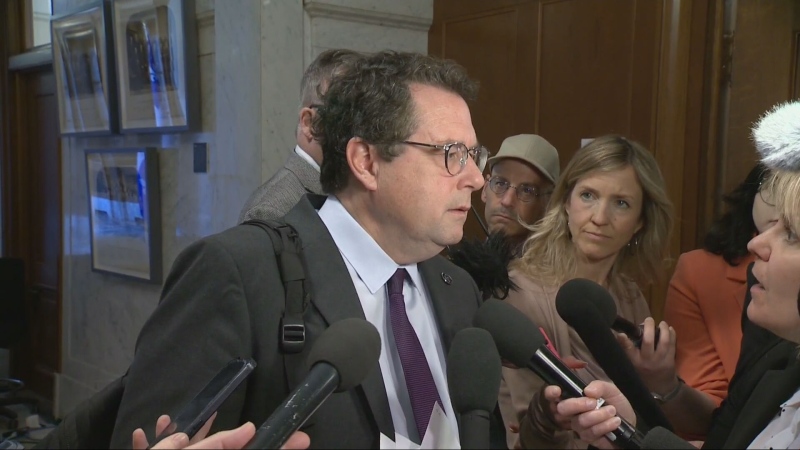

Revenue Quebec wouldn’t comment on the matter, but tax lawyer Paul Ryan said he is outraged by the situation.

“Revenue Quebec has been after a lot of restaurants lately,” said Ryan.

In an attempt to reach a zero deficit, Ryan said Revenue Quebec is auditing more people and businesses than ever.

“Through audits, in those days Revenue Quebec was bringing in $2 billion per year, they asked them to almost double their output.”

Three years ago, Revenue Quebec sought to bring restaurants in line, by ensuring that every bill was accompanied by a barcode, making it harder to hide cash sales.

Revenue Quebec believes restaurants are continuing to hide sales.

Some argue the manner in which restaurant taxes are calculated is questionable.

For example, if a restaurant has wine sales totalling $50,000, Revenue Quebec assumes that wine accounts for, say, 20 per cent of all sales. Revenue Quebec estimates the restaurant should then have $2 million in total sales. If the restaurant only declared sales of $1.2 million overall, Revenue Quebec demands they pay taxes on the difference – in this case $800,000.

“They’re assuming that people are cheating in Quebec for civil audit purposes. You are presumed guilty instead of innocent unfortunately,” said Ryan.

In other cases, restaurants that give away free bottles of wine to loyal customers – a fairly common practice – are asked to pay tax on that bottle, and on the meal Revenue Quebec estimates should have accompanied it.

“The problem is some restaurants don't keep traces of this,” said Dominique Tremblay of the Quebec Restaurant Association, adding that it’s best to keep meticulous records to avoid problems. “You keep a book, you write the alcohol you're keeping for the kitchen, for the employees’, free alcohol you give to customer.”

But restaurateurs argue don't have the time or resources to do that, and furthermore insist that with most sales being on debit or credit card, it’s next to impossible to cheat.

These issues are making Quebec a less attractive location to open a restaurant, said Ryan.

“The word is starting to spread around that doing business in Quebec is more and more difficult due to many factors, including those factors,” he said.