A tribunal has approved a $43 million settlement for 1,100 investors who lost their life savings in the Mount Real financial scandal.

The former investment company was shut down in 2005 and former CEO Lino Matteo, along with four other executives, were charged with hundreds of violations of Quebec's Securites Act three years later.

About 1,600 people lost $130 million because the company was essentially operating as a Ponzi scheme, offering people between eight and 12 percent return on their investment.

Instead the company collapsed, and the victims who lost their life savings filed a class action lawsuit against the accounting firms that should have keep a close watch on the company.

Last fall an out-of-court settlement was reached between Mount Real's auditors and security trustees, with no admission of liability.

Investors had until February 14, 2017 to file a claim, which gets them back roughly 50 cents on the dollar, while lawyers will get about 20 percent of the $43 million payment.

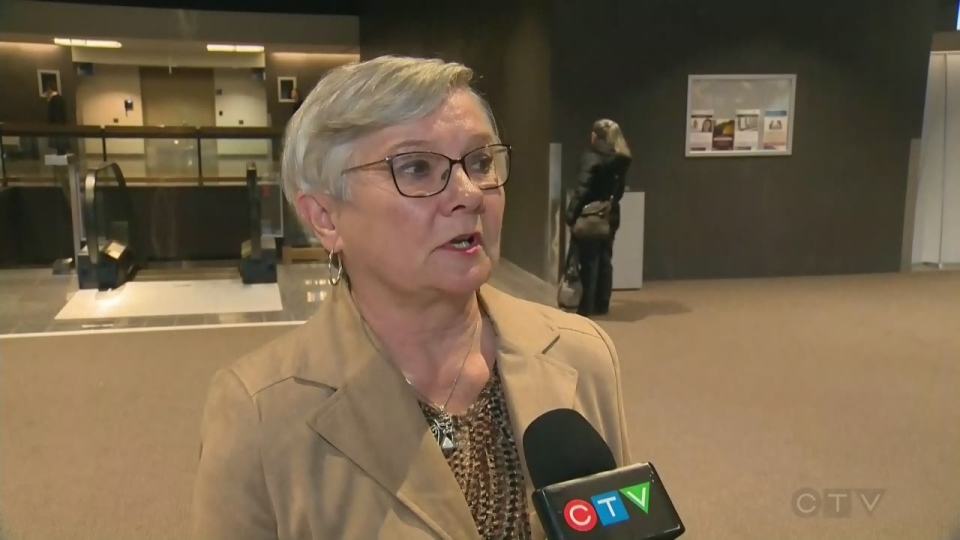

Janet Watson, one of the victims who spearheaded the lawsuit, is satisfied she's not left completely penniless.

"In the case of the Mount Real creditors, we followed all the rules. I think the majority of our financial advisors were registered and Mount Real was listed on the Stock Exchange. It was being auditing by well-known auditing firms, so we pretty much followed all the rules and we still got stung," said Watson.

The law firm of Trudel, Johnston, and Lesperance is still reviewing claims to ensure everyone is eligible.

Some tax repercussions also have to be taken into account.

But by September, the victims should start receiving their cheques.